Tax Exempt

Tax-Exempt Instructions

Are you a non-profit, municipality, or otherwise tax exempt? Add your tax-exempt certificate to your account, get your account approved, and use it every time you want to make a purchase!

The states we collect tax from are ME, MA, NY, NJ, MI, IL, IN, CT, KY, OH, PA, RI, VT. If you are not in one of these states, you do not need to file a tax exemption application.

To do this follow these steps:

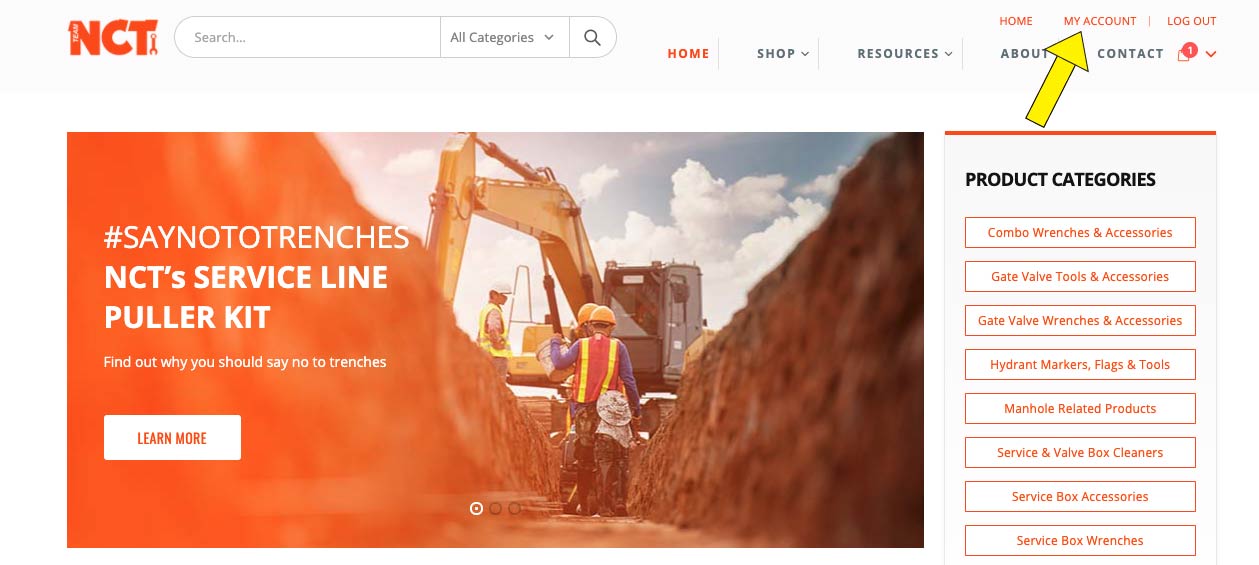

Step 1

Log in to the “My Account” area. If you don’t have an account, you can create one here.

See the attached screenshot:

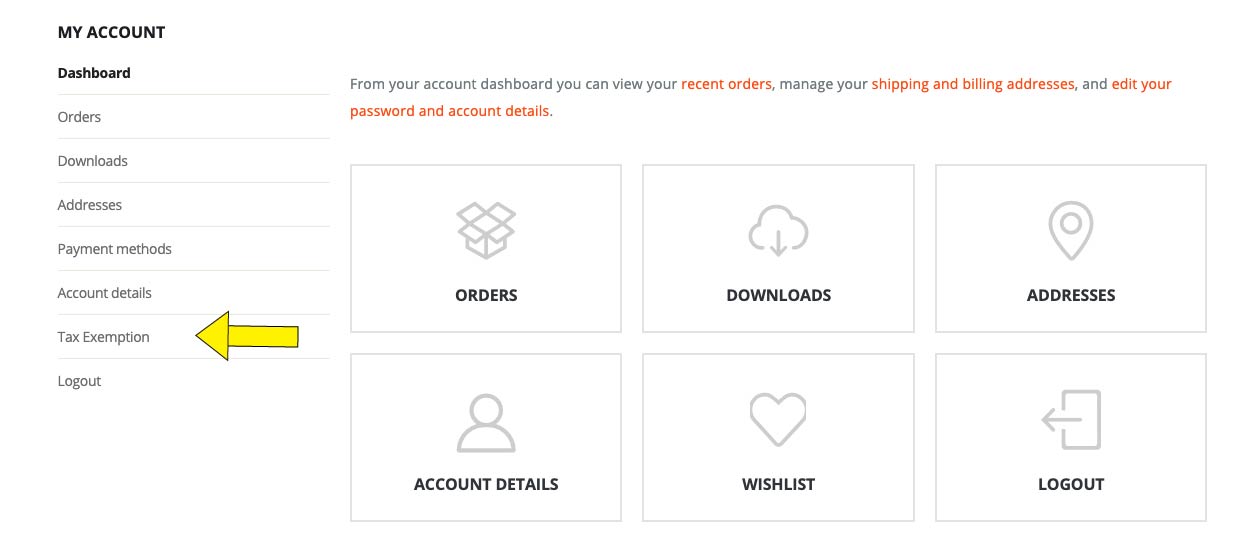

Step 2

Once you’ve logged in, you’ll see a list of menu options on the left. Down towards the bottom, you will see “Tax Exemption” – click this option.

See the attached screenshot:

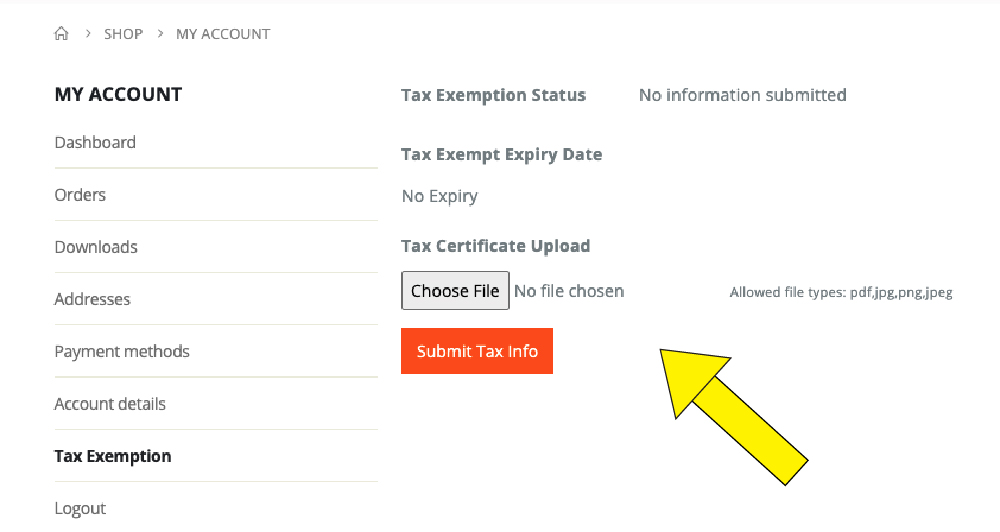

Step 3

On this screen, upload your file of your tax exemption certificate (in one of the approved formats to the right of the arrow). Once you’ve submitted your certificate, we will review it and be in touch asap.

Please Note! We will try to review in 24hrs or less, unless the document was submitted on a weekend.

See the attached screenshot: